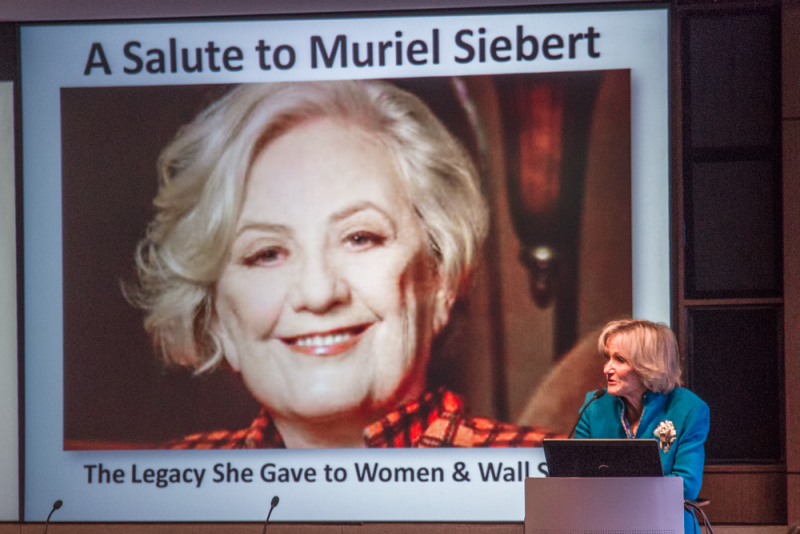

Plenty of ambitious women in the financial services industry have banged their heads into the glass ceiling and some, like Mickie Siebert back in the ‘60s, break it. She was the first woman to get a seat on the New York Stock Exchange and was the first woman to head a NYSE’s member firm.

Siebert lead the way for other women who are now using their know-how to pioneer a new sector within the financial services industry: crowdfinancing. In new industries, women don’t have to contend with pre-existing good ole boys networks,” said Dara Albright, Crowdnetic. “Women are measured by how good they are, not by who they know.”

Crowdfinancing pools money from a group of investors via the internet and social media. It provides access to money beyond the traditional debt and equity products that are funded primarily by institutions. Instead, it uses peer-to-peer and peer-to-business lending as well as equity-crowdfunding. A floodgate of opportunities is opening up for investors, companies in need of funds, and companies that will serve the industry. “A financial services sector that has more women in it will be healthier, less volatile,” said Jilliene Helman, Realty Mogul. “Women have less appetite for risk.”